Transforming a Nation: How QRIS Transformed Indonesia’s Digital Economy

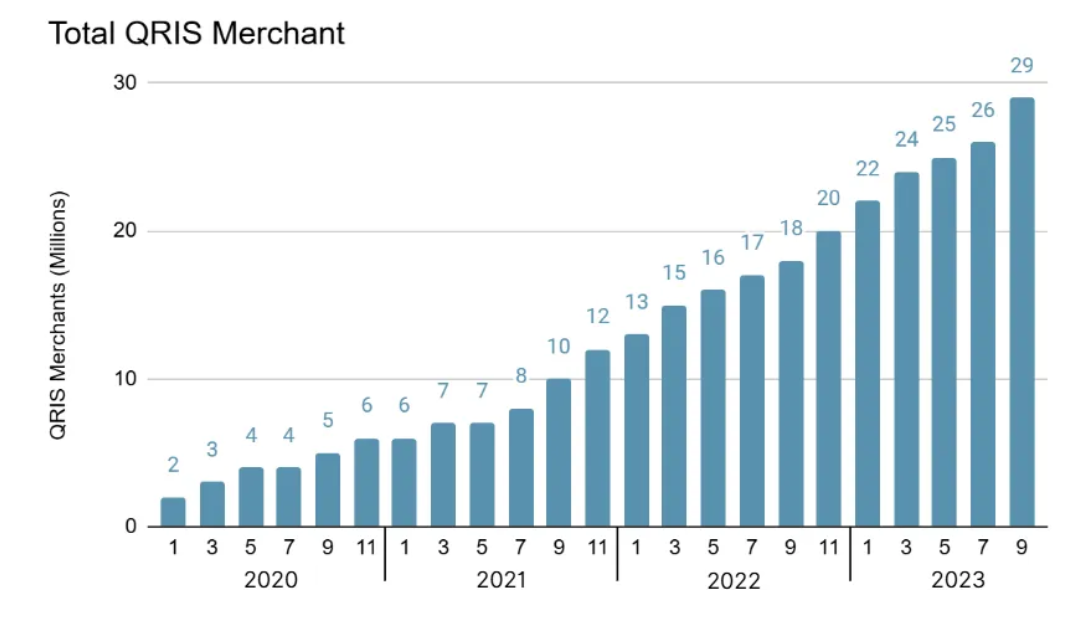

Quick Response Code Indonesian Standard (QRIS) is a unified, real-time payment system developed by Bank Indonesia (BI) in collaboration with the Indonesian Payment System Association (ASPI). Launched in 2019, QRIS was designed to integrate and streamline all non-cash payment methods across the country, serving as a single standard for digital transactions. The system supports both peer-to-peer (P2P) transfers and person-to-merchant (P2M) payments, making it a versatile and inclusive solution for Indonesia’s diverse payment ecosystem. QRIS quickly gained traction and became the national standard for QR code-based payments. Merchant adoption soared from approximately 2 million in 2020 to over 29 million by 2023. Compatible with any smartphone equipped with a QR code scanner, QRIS democratizes digital payments even in rural and underserved areas. The rollout of QRIS Tap, which leverages near-field communication (NFC) technology, further enhances user experience and adoption. Given this rapid and widespread adoption, the question arises: what factors contributed to QRIS’s success, and what can product managers and policymakers learn from it?

Source: Asosiasi Sistem Pembayaran Indonesia

Product Design Decisions Driving Widespread Adoption of QRIS

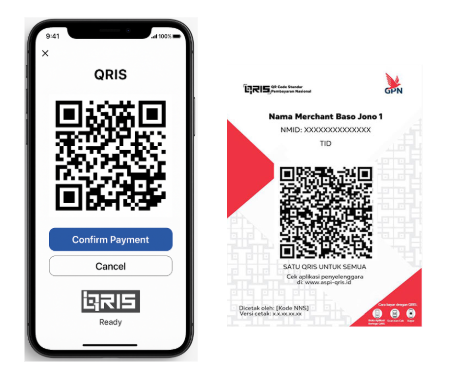

QRIS is interoperable by design, offering a single standardized QR code based on the EMVCo specification, which can be scanned by any supported payment app. Prior to the introduction of QRIS, merchants need multiple QR displays for each payment provider such as GoPay, OVO and DANA among others. With QRIS, a single QR code works for payments from any participating bank or e-wallets. This design significantly lowers adoption friction as a customer with any banking app or digital wallet can pay any QRIS-equipped merchant, increasing the convenience for both merchants and customers.

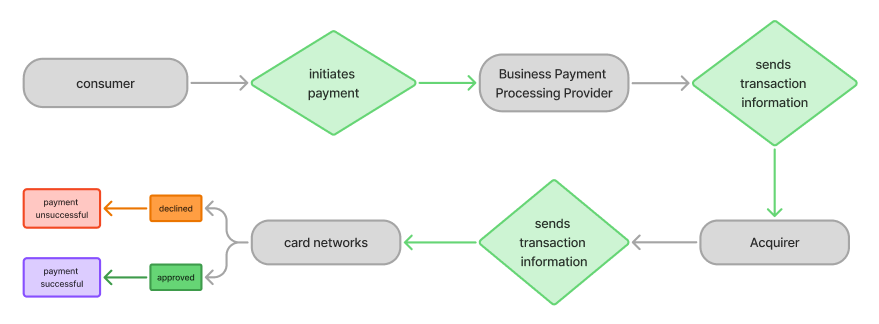

How does it ensure its interoperability? The QRIS system design borrowed from the card networks’ issuer-acquirer model to enable interoperability. Any app that “issues” a QR payment can work with any merchant “acquiring” via another service. For example, if a GoPay user pays a merchant who uses BCA’s QRIS, GoPay’s system will send the payment through the network to BCA’s system, which then settles the funds to the merchant. This off-us transaction hopping is all made possible by the shared QRIS standard and switching agreements. For the user and merchant, it feels seamless – they don’t need to know which intermediaries handle it. The design choice to make QRIS an open, switch-ready system was crucial for achieving smooth integration across Indonesia’s diverse financial sector.

From a UX perspective, paying with QRIS is straightforward. All users need to do is open their preferred banking/e-wallet app, scan the merchant’s QR code, enter the amount and confirm payment. This process is same regardless of the app used which provides a consistent experience that users could trust. The QR format is familiar and requires only a smartphone camera. QRIS also allows for flexibility in which payment can be made through a merchant-presented or customer-presented QR. This standardisation of payment flow across platforms remove confusion in usage among users and makes cashless payment as simple as “scan and pay”.

A look into merchants and users’ perspectives

For merchants, QRIS offers a low barrier of entry for them. Bank Indonesia capped the Merchant Discount Rate (MDR) - which is the fee charged merchants for each transaction made via QRIS - at 0.7% for most transactions and even 0% for small merchants in certain cases. It is a percentage of the transaction value and is paid to the payment service provider (e.g., bank, fintech, or acquirer) for processing the payment. This low fee when QRIS is first implemented made QRIS one of the cheapest acceptance methods for merchants. BI also enforced no minimum transaction amounts, so even the smallest micropayments can go digital. This cheaper pricing for merchants serve as a catalyst to encourage adoption.

For users, the introduction of QRIS provided increased convenience and increased utility for users. Prior to QRIS, a problem users faced was the fragmented payment flows. This problem suggested a unified solution which is able to align multiple stakeholders with a consistent user experience. This increased convenience combined with the ease of use for users resulted in the significant number of usage over the span of a short period of time.

On a Broader Scale..

The implementation of QRIS goes beyond providing convenience for users. It serves as a catalyst for systemic transformation within Indonesia’s economy. Designed as an interoperable, low-cost, and user friendly solution, QRIS has enabled millionsof micro, small, and medium-sized enterprises (MSMEs) to formalise their operations by adopting digital payment system. This formalisation is critical in expanding Indonesia’s financial ecosystem, helping improve access t4o credit and support better financial inclusion.

From a macroeconomic perspective, QRIS contributes to increased labour productivity, a key driver of total factor productivity and thereby, GDP growth, by reducing cash-handling inefficiencies and accelerating transaction speed. In the long run, this digitisation of the informal sector helps foster sustainable economic growth, reduce the reliance on cash-based economy and strengthen Indonesia’s resilience to future economic shocks by embedding digital infrastructure into the heart of commercial activity.

Tags:

-

product management

-

payment system

-

digital economy

Written by

Michelle Louisa

Product Manager

based in Singapore